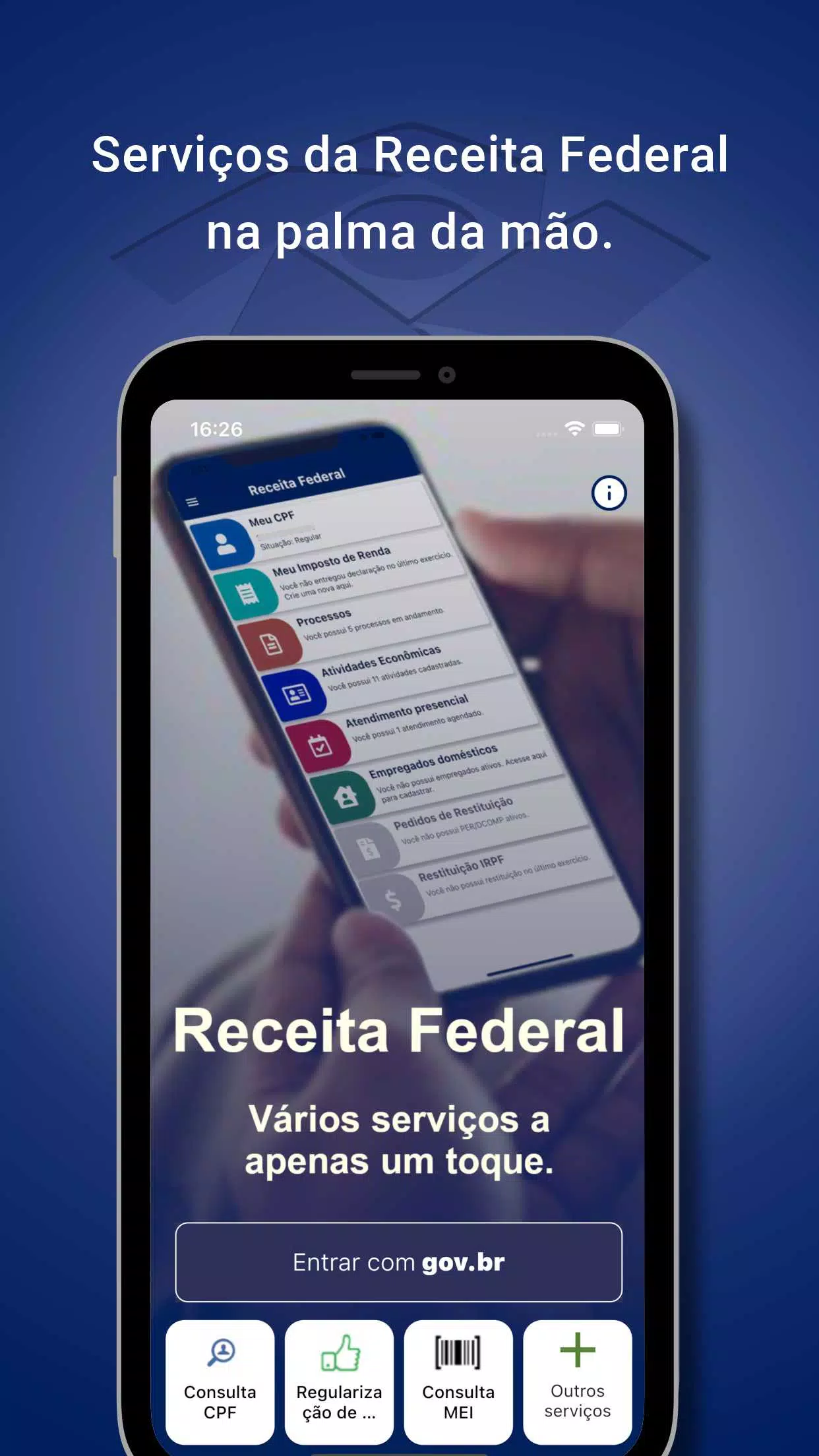

This app provides a comprehensive overview of your CPF (Cadastro de Pessoa Física, Individual Taxpayer Registry) across various Brazilian Federal Revenue systems. Several services require a separate Federal Revenue application download, indicated by an asterisk (*).

Key Features:

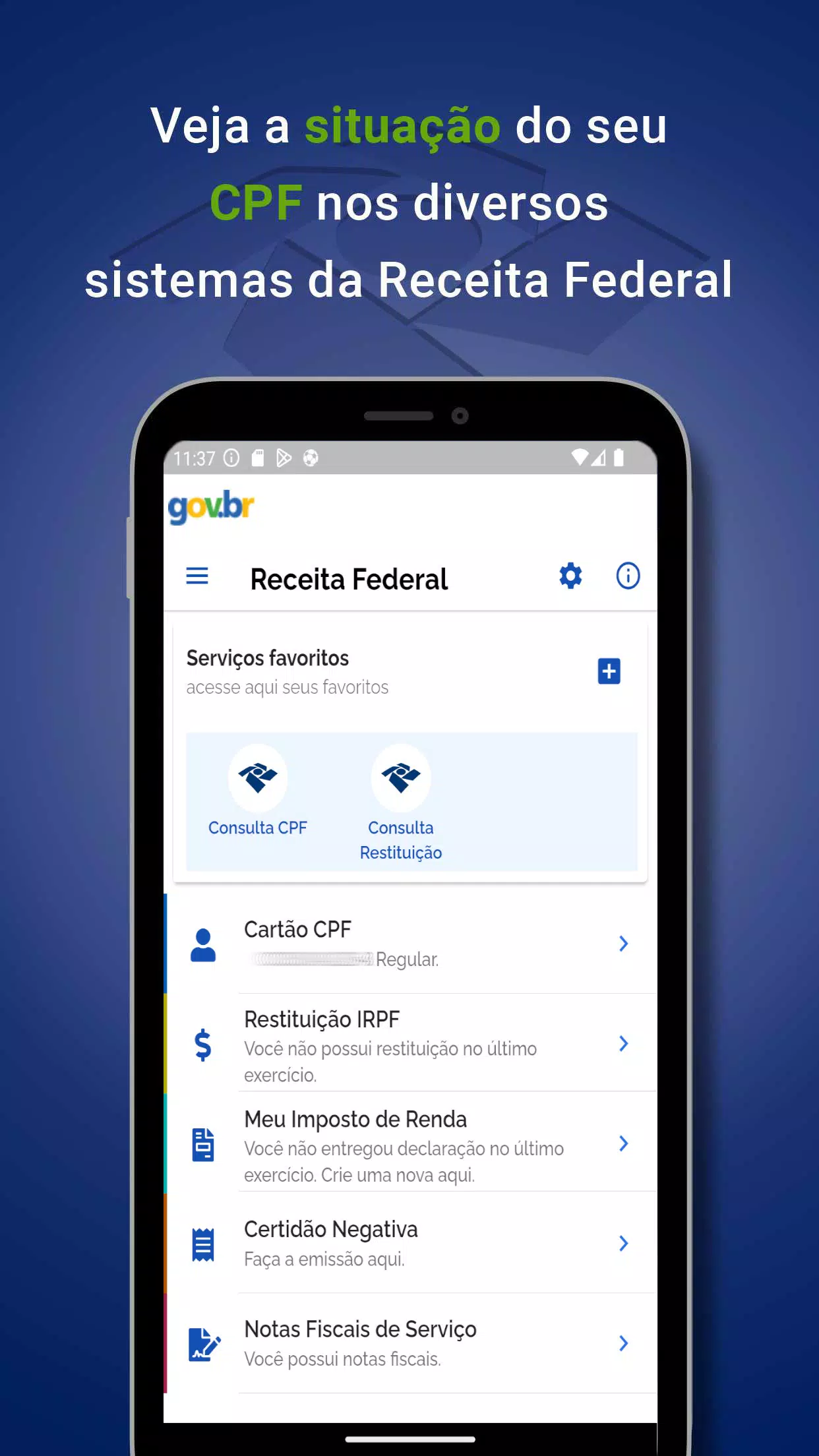

- CPF card details

- Negative debt certificate

- IRPF (Income Tax) refund status

- Income tax declarations*

- In-progress processes*

- Economic activities (CAEPF)

- Schedules (SAGA)*

- eSocial (domestic employees)*

- My Companies (including MEI)*

- Import details (declarations and Bill of Lading)

- Refund requests (PERDCOMP)

- Service invoices

- Health Recipe information

Additional Resources: Beyond CPF information, you can access CNPJ (company registration) details, MEI (Microempreendedor Individual, Individual Microentrepreneur) status, CNAE (National Classification of Economic Activities) codes, NCM (Nomenclature of Goods) tables, RFB (Federal Revenue) unit locations, legal regulations, Sicalc (a tax calculation tool), import simulation tools, and much more.

Access Levels:

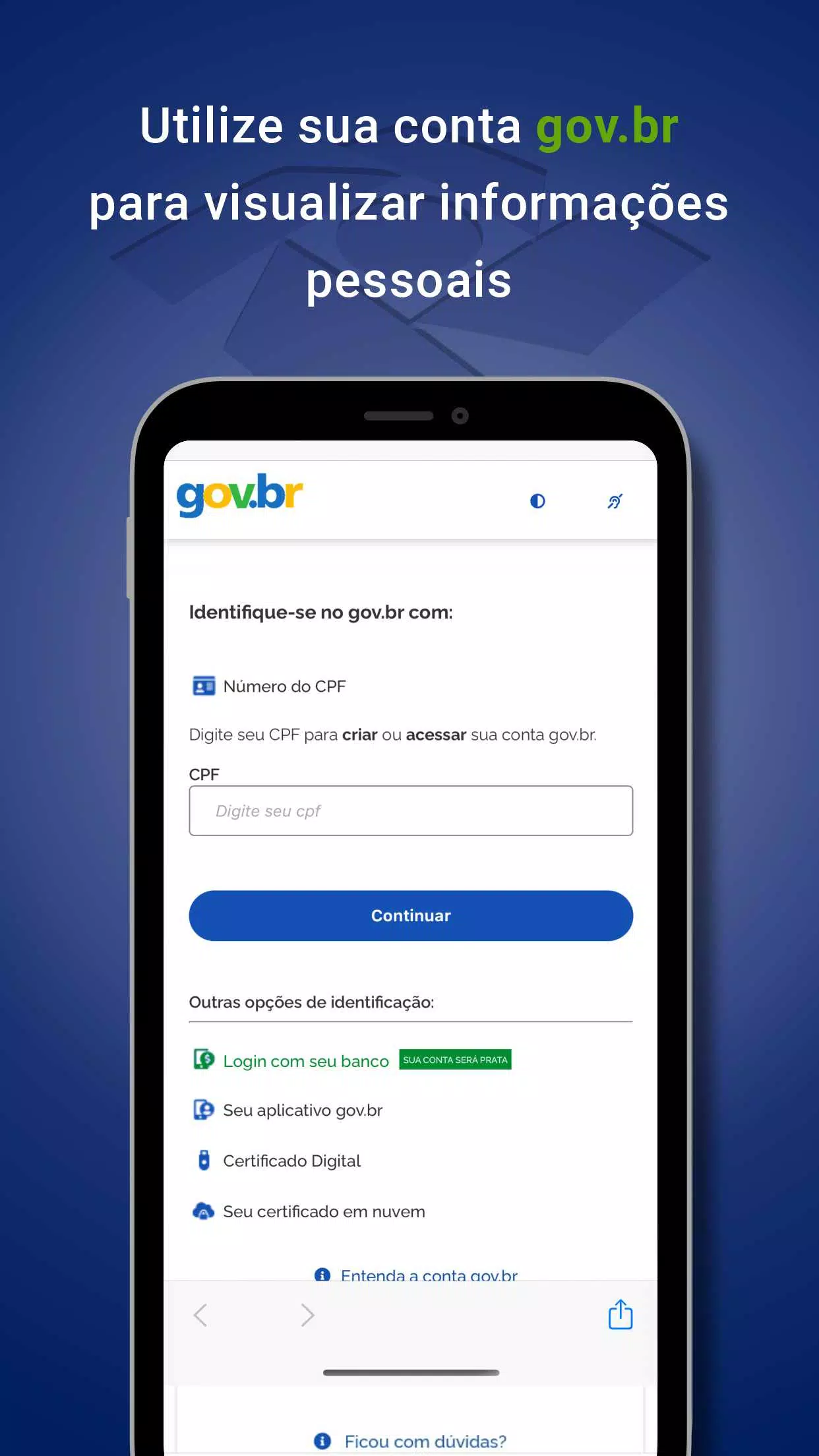

The level of detail and functionality depends on your authentication status:

-

Unauthenticated (without gov.br login): Access is limited to basic information. You cannot save favorites and will need to complete a CAPTCHA for each query.

-

Authenticated (with gov.br login): You'll have access to enhanced features:

-

No CAPTCHA required.

-

Ability to save frequently accessed CPF/CNPJ numbers as favorites.

-

(Coming soon) Alerts for account activity.

-

Third-party data access: Limited to basic information.

-

Your own data ("My Data"): Full access to your personal information.

-

This app streamlines your interaction with the Brazilian Federal Revenue Service, providing convenient access to a wide range of important information.